The overall economic environment has been and remains weak. Real GDP’s four-year CAGR from 2010-2013 is only 2.25%. Retail sales are weak too – growing 2.4% in Q1. Yet, ecommerce remains strong – growing 15% in Q1. Even in a stagnant economy there are secular growers. EBAY’s key metrics are growing even faster than ecommerce. Off-EBAY PayPal usage is accelerating. Merchant Services Total Payment Volume grew 33% y/y in Q2 2014. EBAY’s shares have been flat for six quarters, but intrinsic value continues to grow.

[et_pb_section bb_built=”1″][et_pb_row][et_pb_column type=”4_4″][et_pb_text _builder_version=”3.15″]

While the overall economy’s slow growth presents an investment headwind, there are still opportunities. Of course, sales growth is not a prerequisite for investment success. Plenty of people have gotten rich buying depleting assets like oil wells. Price paid is always the determining factor. But, secular1 growth has its merits, particularly in a world where growth is scarce. A growing company with a competitive business advantage can reinvest capital at a high rate. Owners can compound their return rather than continually look for the next place to put the proceeds of their royalty stream (to use the oil well analogy again).

Two of the most powerful secular growth trends today are the shift from offline retail to e-commerce and the shift from physical currency to cashless transactions. eBay (EBAY) is well positioned to take advantage of both of these trends.

The first half of this year was full of noise and distractions for EBAY: publicly-hostile correspondence with activist investor Carl Icahn (who did make some good points), a security breach that forced a system-wide password reset, and a new algorithm from Google that had a detrimental impact on search results for eBay listings. Despite these challenges, EBAY grew Enabled Commerce Volume (ECV) 26% year-over-year in the second quarter. This is up from 20% in the first quarter of 2013. And, it is significantly better than the already strong growth in ecommerce. The US Census Bureau estimates ecommerce grew 15% in the first quarter compared to 2.4% for all retail sales.2

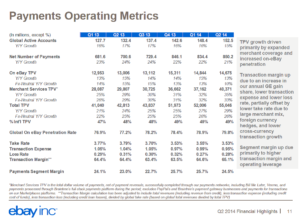

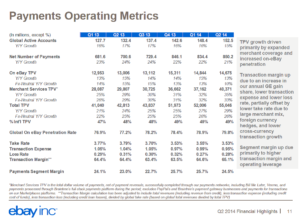

While EBAY’s company-wide trends are strong, PayPal’s trends are even stronger. Every single metric is solid, but we are particularly excited to see Merchant Services Total Payment Volume growing at an accelerated rate – from 26% year-over-year in the first quarter of 2013 to 33% in the second quarter of 2014. This tells us that PayPal is NOT just being used within eBay’s Marketplaces. More and more, it is being used across ecommerce (and even offline) to facilitate payments.

Figure 2 – EBAY’s payment metrics slide from the Q2 2014 earnings call shows strong growth in merchant services TPV.

We first discussed our eBay position in our third quarter 2013 letter. At the time of that letter, EBAY shares traded just above $50. We wrote, “We initially purchased eBay shares in December 2011. At the time, eBay was unloved trading at 18x 2011 earnings per share and just 12x 2012’s prospective earnings. Since then, eBay’s shares have returned over 75%, but that return was all in 2012. Shares have been flat throughout 2013.” It is now nine months later and we can say shares were flat for all of 2013, as well as the first two quarters of 2014. In other words, our EBAY investment has not produced results for six quarters. However, intrinsic value has grown significantly. This is the more important metric for the long-term investor.

While the economy is growing at low-single digit rates, EBAY’s industry (ecommerce) is growing in the mid-teens, and EBAY’s participation in this industry (its ECV) is growing in the mid-20s. Yet, EBAY trades at the same multiple as the S&P 500. With the S&P 500 at all-time highs and growth scarce, there are few bargains. We think EBAY is one.

This article is an excerpt from our Q2 2014 quarterly letter.

1 A trend that is neither cyclical nor seasonal but long-term in nature.

2 Click here

Disclosure: At the time of publication, GOCM was long EBAY. The information contained herein should not be construed as personalized investment advice. Past performance is no guarantee of future results. There is no guarantee that the views and opinions expressed in this newsletter will come to pass. Investing in the stock market involves the potential for gains and the risk of losses and may not be suitable for all investors. Information presented herein is subject to change without notice and should not be considered as a solicitation to buy or sell any security. Any information prepared by any unaffiliated third party, whether linked to this newsletter or incorporated herein, is included for informational purposes only, and no representation is made as to the accuracy, timeliness, suitability, completeness, or relevance of that information. The stocks we elect to highlight will not always be the highest performing stocks in the portfolio, but rather will have had some reported news or event of significance or are either new purchases or significant holdings (relative to position size) for which we choose to discuss our investment tactics. They do not necessarily represent all of the securities purchased, sold or recommended by the adviser, and the reader should not assume that investments in the securities identified and discussed were or will be profitable. A complete list of recommendations by Grey Owl Capital Management, LLC may be obtained by contacting the adviser at 1-888-473-9695.

[/et_pb_text][/et_pb_column][/et_pb_row][/et_pb_section]